Revolutionizing Auto Insurance Fraud Detection with Advanced Analytics

About the Author

Piotr Kramek, is adept at designing and deploying sophisticated analytical solutions to combat complex financial crimes, particularly in the insurance sector. His expertise lies in leveraging dynamic scoring, link analysis, and comprehensive data integration to identify organized fraud schemes and significantly enhance investigative efficiency.Table of Contents

- Why is detecting auto insurance fraud so challenging?

- How does DataWalk enhance fraud detection with scoring and rules?

- What role does graph analysis play in uncovering fraud rings?

- How can analysts triage alerts and reduce false positives?

- What makes DataWalk a comprehensive platform for insurance fraud?

Auto insurance fraud is a complex, evolving problem that erodes profitability and strains analytical resources. DataWalk provides a comprehensive platform that empowers insurers to move beyond static rules, enabling them to dynamically score claims, visualize hidden connections in data, and efficiently triage alerts to stop fraudulent payouts before they occur.

Why is detecting auto insurance fraud so challenging?

Modern insurance fraud is rarely a simple, isolated event. It often involves sophisticated, organized schemes designed to exploit systemic weaknesses. Fraudsters leverage complex networks of colluding individuals, including claimants, agents, and service providers, to submit claims that appear legitimate on the surface. Traditional detection methods, which often rely on static business rules, are easily bypassed and generate a high volume of false positives, overwhelming analysts and delaying legitimate payments.

How does DataWalk enhance fraud detection with scoring and rules?

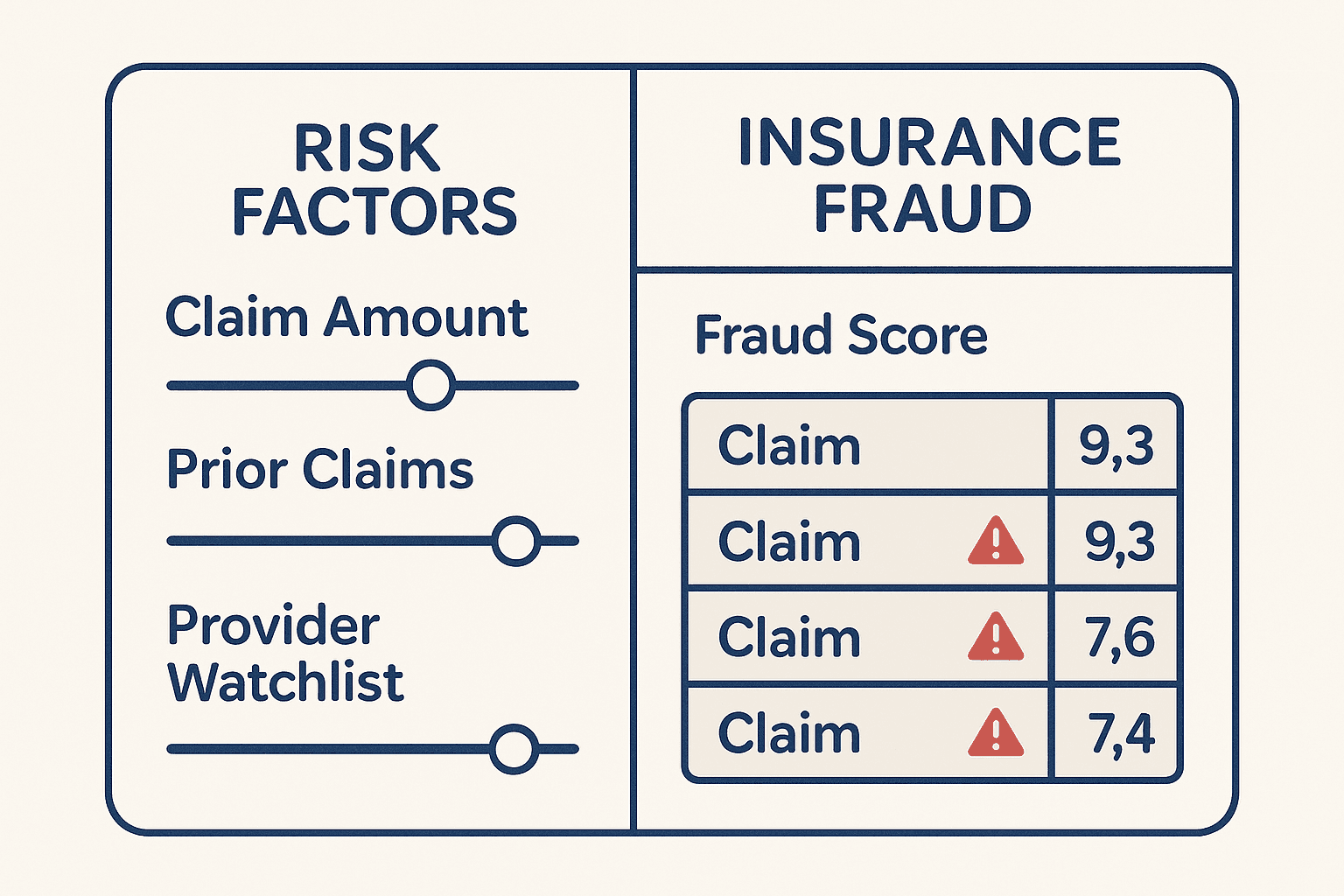

DataWalk transforms fraud detection by enabling the creation and continuous tuning of dynamic scoring rules. Unlike rigid, hard-coded rules, these scores can be informed by a combination of expert knowledge, refined with machine learning models, and adapted in real-time as new fraud patterns emerge. This allows an organization to build a sophisticated risk assessment model tailored to its specific business environment.

An analyst can assign different weights to various risk indicators, such as a claimant's history, the nature of the incident, the repair shop involved, or geographic risk factors. This flexible scoring system allows for a more nuanced and accurate assessment of claim risk, moving beyond simple red flags to provide a holistic view of potential fraud.

What role does link analysis play in uncovering fraud rings?

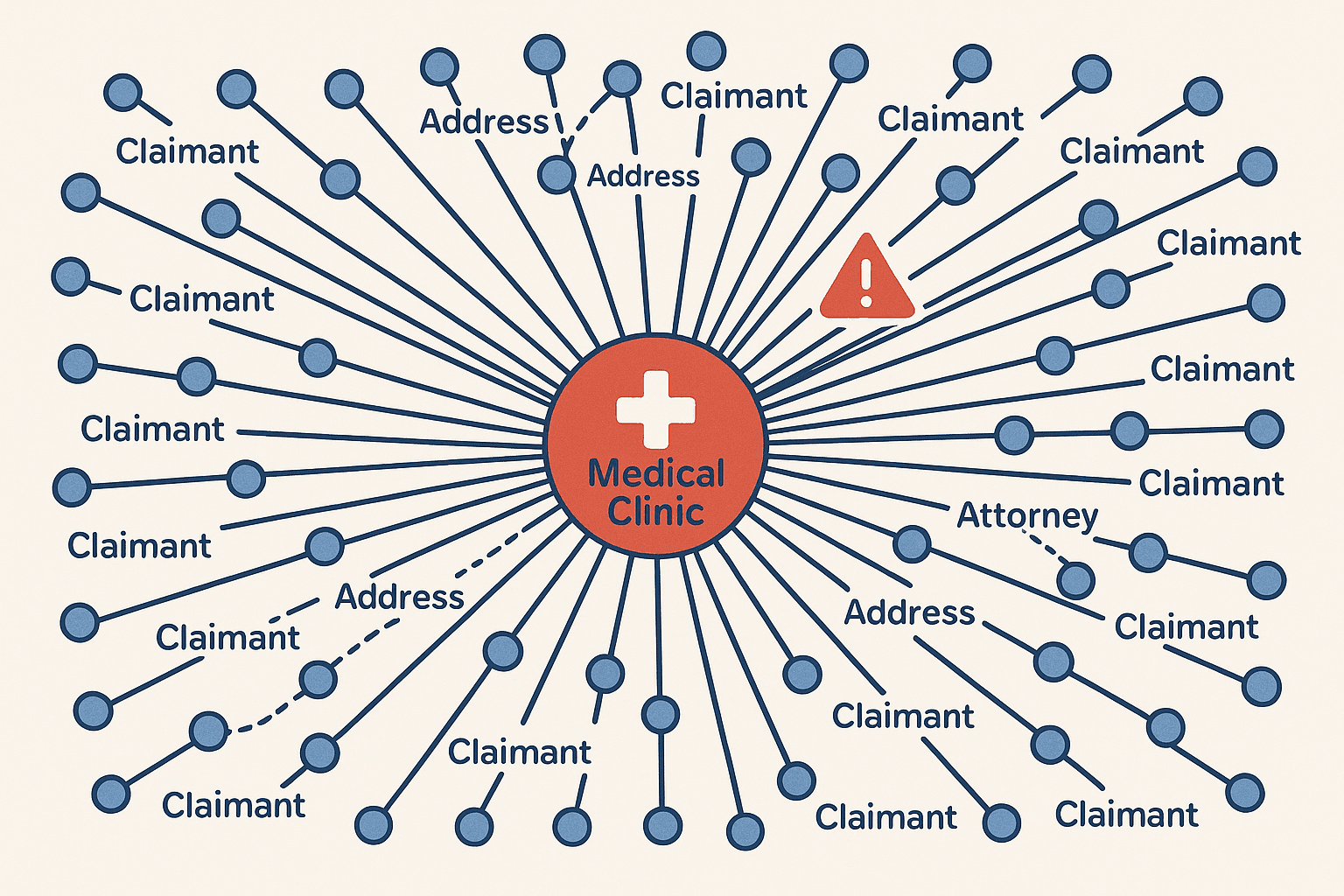

Individual fraudulent claims are often the tip of the iceberg, representing a single part of a larger, organized network. DataWalk's powerful graph analysis capabilities are essential for uncovering these networks. Unique DataWalk technology enables suspicious clusters to be automatically identified across vast amounts of complex data, uncovering collusive behavior that would otherwise remain hidden in siloed spreadsheets or databases.

With DataWalk’s graph visualization, an analyst can see if multiple claimants are using the same phone number, address, lawyer, or medical provider. Visualizing these hidden relationships is the key to understanding and dismantling entire fraud rings, not just denying single claims. This capability is a core component of our fraud detection software.

How can analysts triage alerts and reduce false positives?

A primary challenge in fraud detection is managing the overwhelming volume of alerts. DataWalk provides a clear, visual workspace where claims are automatically scored and prioritized based on the custom rules engine. This allows analysts to immediately focus their attention on the highest-risk cases instead of manually sifting through thousands of low-priority alerts.

This targeted approach significantly reduces the time spent investigating legitimate claims, thereby lowering the rate of false positives and improving operational efficiency. The platform can also be configured to provide auto-suggestions for the next steps in an investigation, guiding the analyst and streamlining the entire triage and case management process.

What makes DataWalk a comprehensive platform for insurance fraud?

DataWalk is more than a detection tool; it is a comprehensive platform for investigation and prevention. It allows you to consolidate and cross-reference all relevant datasets-claims, policies, SIU notes, external watchlists, and unstructured data-in a single, unified analytical environment. This eliminates the data silos that fraudsters exploit.

Analysts can customize data views, build new analytical models, and adjust scoring rules on the fly, without requiring lengthy IT development cycles. This agility is critical for adapting to new fraud typologies and ensuring the detection system remains effective against evolving threats. DataWalk provides the tools to not only find fraud but to understand its root causes and prevent future losses.

Frequently Asked Questions

How does DataWalk integrate different types of insurance data?

DataWalk can connect to and consolidate data from any source, including claims management systems, policy databases, SIU case notes, and external data feeds. It unifies this information into a single, coherent model, allowing analysts to see all relevant data in one place without needing to switch between systems.

Can the fraud scoring rules be customized by our analysts?

Yes. One of DataWalk's key strengths is its flexibility. Analysts and fraud managers can easily create, modify, and tune scoring rules and their respective weights directly within the user interface, without needing to write code or rely on IT support.

What is a "suspicious cluster" in the context of insurance fraud?

A suspicious cluster is a group of seemingly separate claims, people, or entities that are revealed to be connected through shared attributes when analyzed in a network graph. For example, multiple claimants who all use the same doctor, lawyer, and repair shop for similar accidents would form a suspicious cluster indicating potential collusion.

How does the platform help reduce false positives?

DataWalk reduces false positives by replacing overly simplistic, static rules with a nuanced, multi-factor scoring system. By considering the entire context of a claim and its connections, the platform can more accurately distinguish between genuinely suspicious activity and benign anomalies, allowing analysts to focus on true threats.

Is DataWalk only for large, high-value claims?

No. DataWalk is effective for analyzing all types of claims. It is particularly powerful at detecting low-value, high-volume fraud schemes where many small, seemingly insignificant claims are part of a larger organized ring that collectively represents a significant financial loss.

How quickly can we adapt to new fraud schemes?

The platform is designed for agility. As soon as a new fraud pattern is identified, an analyst can immediately adjust scoring rules, create new visual alerts, or build new link charts to detect it. This can be done in minutes or hours, not the weeks or months required by traditional systems.

Solutions

Product

Partners

Company

Resources

Quick Links