DataWalk: The Unified Platform for Advanced Fraud Detection & Investigation

About the Author

Piotr Kramek, is an expert in designing and implementing cutting-edge fraud detection systems, showcasing a deep understanding of unified platform architectures and complex data integration. His skills include leveraging advanced analytical techniques like machine learning and social network analysis to significantly improve investigative outcomes and operational efficiency.DataWalk provides a fundamentally different approach compared to other fraud detection software companies. By integrating all necessary capabilities into a single, flexible platform, DataWalk enables organizations to rapidly deploy, connect all relevant data, and significantly improve analytical outcomes. This unified system accelerates investigations and delivers a superior return on investment.

How does DataWalk streamline deployment and data integration?

Traditional fraud detection solutions often require months of complex implementation and significant, ongoing IT support. DataWalk is engineered for rapid deployment, with initial results possible in days, not months or years. The platform dramatically reduces the burden on IT teams, empowering administrators and power users to manage configurations and data model changes.

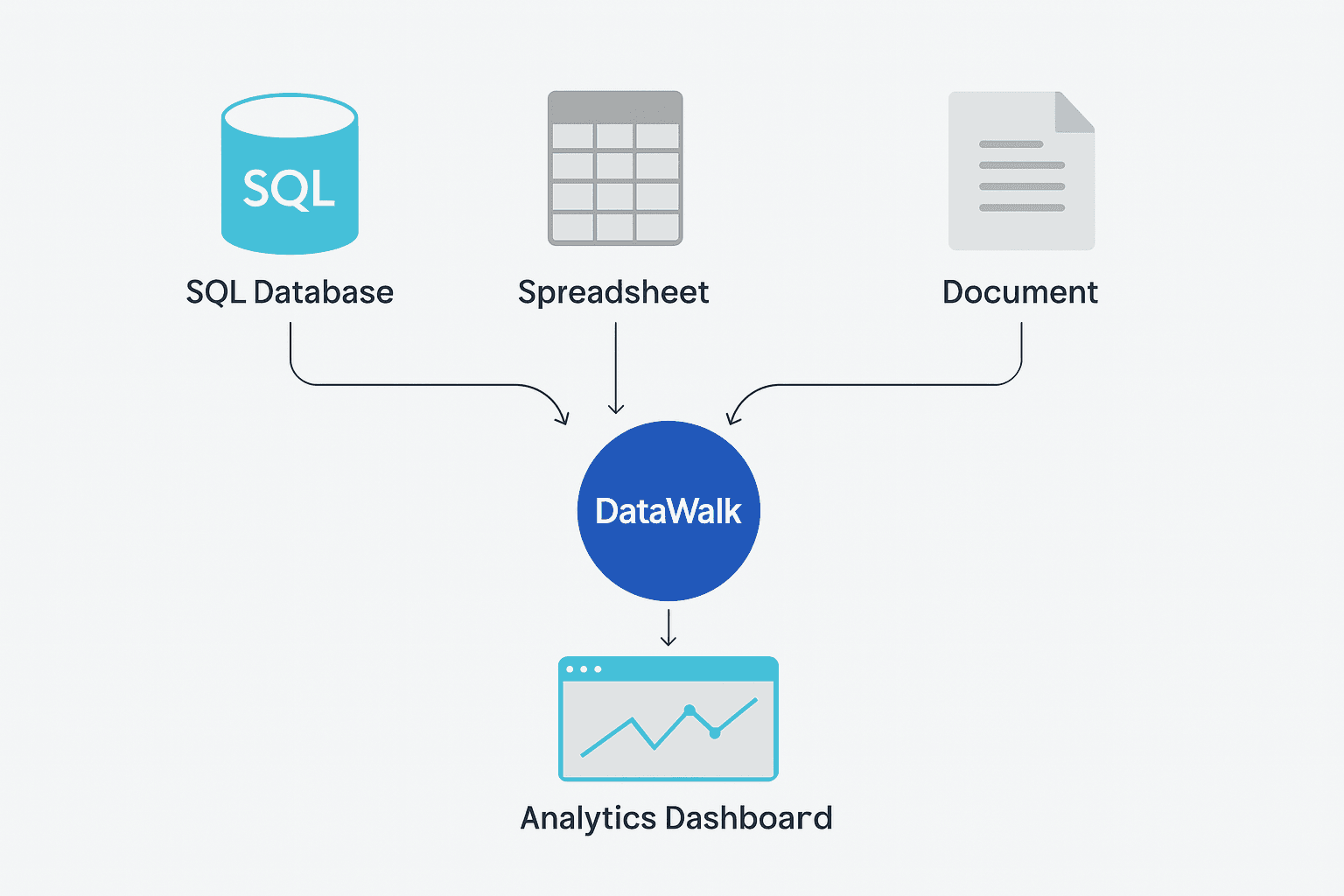

A key differentiator is the ability to connect all desired data–structured and unstructured–from internal databases, public records, and third-party services into a single repository. Unlike systems that demand massive, upfront data cleanup projects, DataWalk can ingest your data "as-is". Any necessary transformations can then be performed directly within the platform, vastly simplifying and accelerating the data preparation phase.

What makes DataWalk's analytical approach to fraud detection superior?

DataWalk delivers breakthrough flexibility across the entire solution. It features a flexible logical data model that makes it simple to connect new data sources or modify relationships between existing ones. Scoring and rules can be configured or modified with a few clicks through an intuitive visual interface, allowing business users to adapt to new fraud schemes without extensive IT intervention.

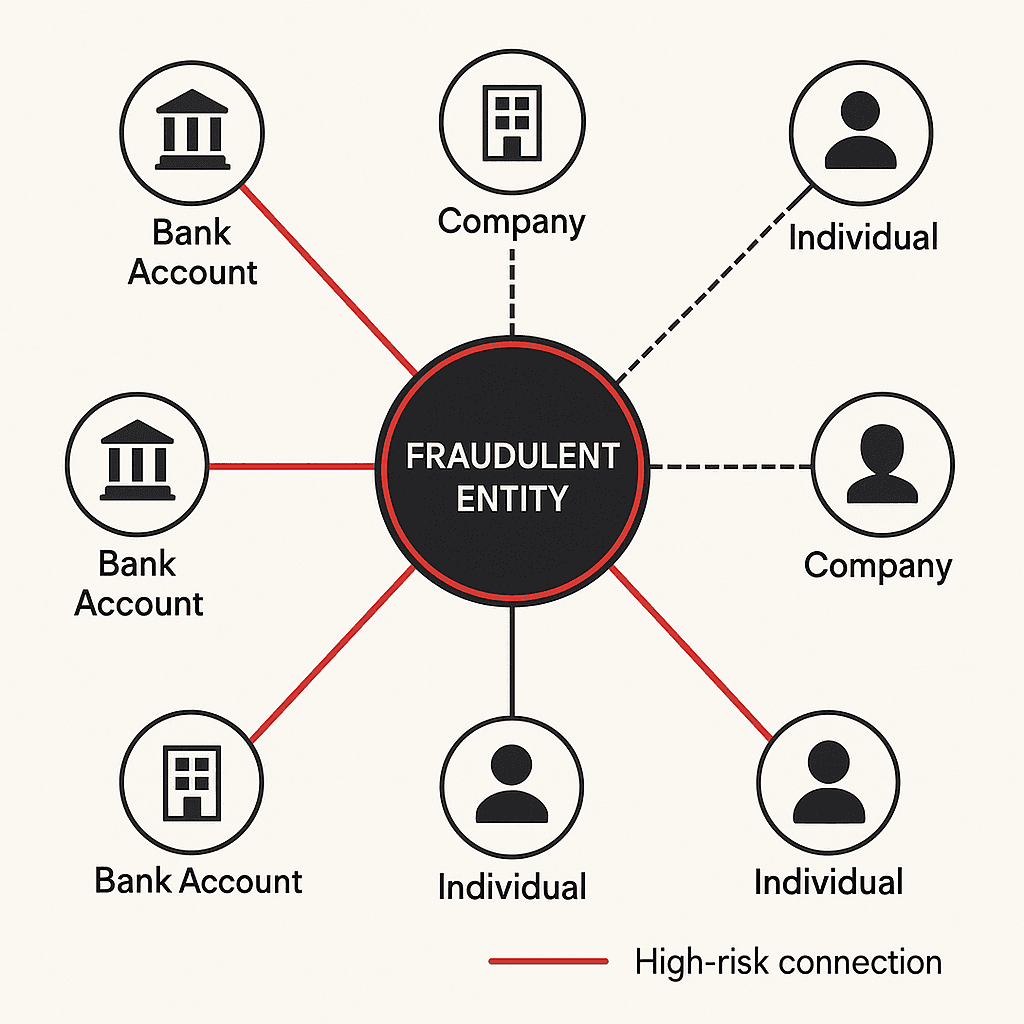

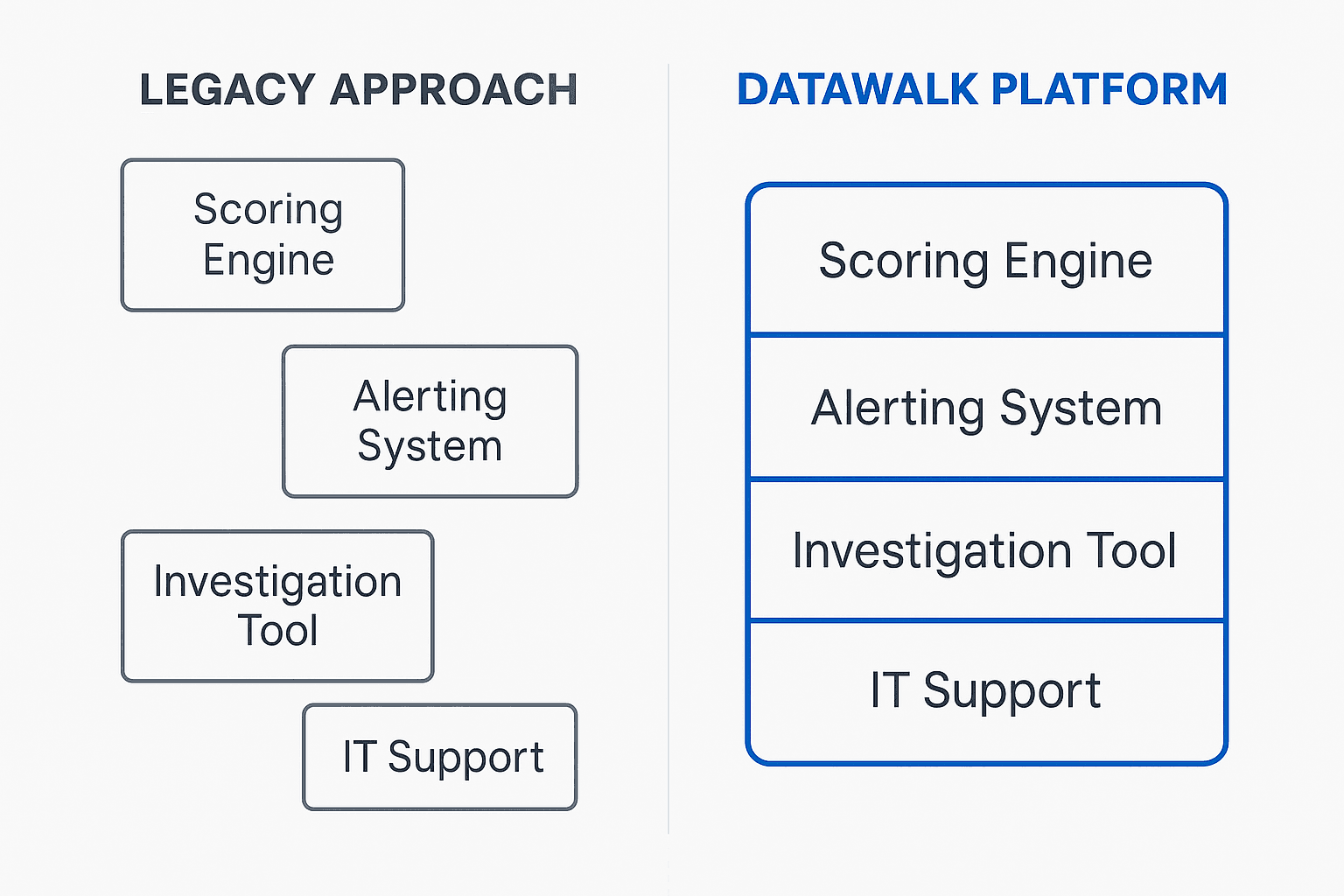

Crucially, DataWalk is a single platform that combines scoring, alerting, and investigation. All scored claims or cases can be instantly visualized on dynamic link charts, enabling analysts to uncover hidden relationships and networks. The system can automatically scan data to identify and visualize organized crime groups and other suspicious clusters. These built-in investigation tools, including advanced link analysis, integrated mapping, and time-series analysis, are core to the platform, not separate add-on applications.

How does DataWalk improve operational efficiency for fraud teams?

A primary objective of the DataWalk platform is to enhance the productivity of fraud investigation teams. By providing more accurate scoring and sophisticated pattern detection, DataWalk helps to dramatically reduce false positives. This allows analysts to focus their time on the highest-risk cases, and in some instances, organizations have been able to accelerate or even eliminate the traditional triage function entirely.

The platform is also designed for seamless collaboration. Authorized colleagues can easily share data, analyses, and complete investigation files within the secure DataWalk environment. This eliminates information silos and ensures that all team members are working with the most current and comprehensive intelligence, leading to faster and more effective case resolution.

Why is DataWalk a more flexible and cost-effective solution?

DataWalk delivers breakthrough flexibility across the entire solution. It features a flexible data model that makes it simple to connect new data sources or modify relationships between existing ones. Scoring and rules can be configured or modified with a few clicks through an intuitive visual interface, allowing business users to adapt to new fraud schemes without extensive IT intervention.

This flexibility extends to deployment, with options for on-premise installation behind a corporate firewall or secure cloud deployment. By consolidating multiple functions into one system, eliminating the need for separate applications, and reducing IT overhead, DataWalk provides a comprehensive and powerful solution that is often a fraction of the cost of comparable alternatives from other fraud detection software companies.

Frequently Asked Questions

How quickly can DataWalk be deployed and show results?

DataWalk is designed for rapid deployment. While traditional systems can take months, DataWalk can be installed quickly, with initial analytical results often available within a few hours or days.

Does my data need to be perfectly clean before using DataWalk?

No. A key advantage of DataWalk is its ability to ingest data "as-is" from various sources. Any required data cleaning and transformation can be performed within the platform, eliminating the need for a separate, time-consuming data preparation project.

What analytical techniques does DataWalk use to detect fraud?

DataWalk employs a combination of powerful techniques, including user-defined rules, machine learning, graph analysis, and other technologies to provide more accurate and comprehensive scoring and pattern detection.

Is DataWalk a cloud-only solution?

No, DataWalk offers flexible deployment options. It can be installed on-premise within your own data center or deployed in a secure cloud environment, depending on your organization's infrastructure strategy and security requirements.

How does DataWalk help reduce the number of false positives?

By using a multi-faceted analytical approach and integrating all data into a single view, DataWalk generates more precise risk scores. This higher accuracy significantly reduces the volume of false positive alerts, allowing investigation teams to focus on genuine threats.

Can a business analyst change fraud detection rules in DataWalk?

Yes. DataWalk features an easy-to-use visual interface for creating and modifying rules and scoring logic. This empowers authorized power users and analysts to adapt the system to new fraud schemes quickly, without needing to rely on IT for coding changes.

Solutions

Product

Partners

Company

Resources

Quick Links